Need a bank but hate the idea of banks? Maybe it is the question of wondering if your money is going to line bankers’ pockets while they nickel and dime you with fees at every turn. If that’s the case, then you’re going to want to hear about Chime.

Chime is mobile banking for those who don’t have trust funds. Built as a mobile and online bank from the ground up, Chime has normal people in mind as its customers, not millionaires. That means that Chime will treat you with respect and courtesy, all while not charging you outrageous fees for the privilege of holding on to your hard-earned cash.

| Chime – Mobile Banking | |

| Price: Free Category: Finance |

|

| Version: Varies by device Developer: Chime |

Uninstall the app: 1. Go to Settings menu 2. Choose Apps or Application manager 3. Touch the app you want to remove 4. Press Uninstall. |

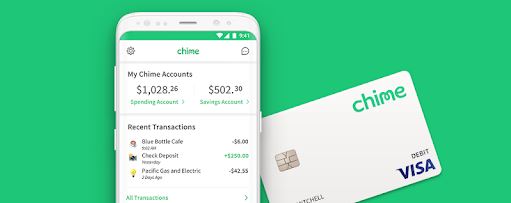

Chime is built from the bottom up as a mobile bank, which means that everything can be handled either online, on the app, or over the phone. Speaking of phones, you apply for a Chime account through the app. If you’re approved, you get a debit card in as little as two weeks. From there, Chime offers a number of great advantages for its account holders, including:

- Free access to over 38,000 ATMs

- No fees of any kind, be they overdraft, account fees, foreign exchange fees, or any other insultingly bad fee your other bank has dreamed up to charge you

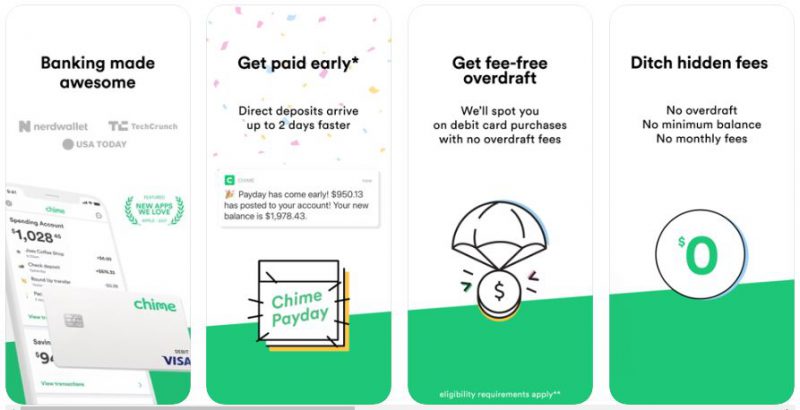

- Get direct deposits up to two days early

With that many ATMs, you’ll have access to as many cash points as many large regional banks provide their customers, and with direct deposits credited to your account up to two days early, you’ll have more money to withdraw, too.

However, the no fees part is likely to convince many people, especially the no overdraft fees. After all, banks make bank off of overdraft fees, with some statistics reporting upwards of a billion a year made by the industry from such fees alone. At Chime, they get that accidents happen, and that overdrawing your account by ten bucks shouldn’t cost you forty to remedy. Because of that, they cover twenty bucks of an overdraft at a time, no questions asked, no fees charged. Just like your friend who is willing to spot you when you forget your wallet, Chime has your back.

Speaking of forgetting your wallet, Chime also offers full integration with Google Pay and Apple Pay, so all you need is your phone. Also, it should go without saying, but Chime does have full FDIC coverage, so your money is safe up to $250,000.

The Downsides

Of course, Chime isn’t perfect. They don’t do overdraft fees, so if you have to go beyond the $20 (or in some cases $100) that they allow, there is no option to pay the $40 overdraft fee. For some people, that may be a sticking point. Additionally, while check deposit is free, depositing cash requires going to a third-party provider and paying a small fee.

Further, there are limits on bill pay; typically you can only write a check for $5,000 on a Chime account. While that may sound like a lot, for some businesses, that is a small enough number to be obnoxious.

Getting Chime

Still, for the right person, there are a number of great reasons to get Chime, and it can well help you take care of your finances so that you can focus on other things. It is handled through apps, so download the mobile app from your favorite app store and install it to apply to be a Chime account holder. It can take up to two weeks to get a card, and a month to get full check-writing privileges. Because of that, if this is something you’re considering, it is best to do it today