The new normal that the world is transitioning to includes one of daily, widespread social distancing and isolation, in efforts to curb the virus and stay safe and healthy. Chores and errands that were once commonplace, such as going to the dentist for a routine appointment, picking up a workday lunch from a nearby restaurant, stopping by a store to buy a new pair of jeans or visiting the auto shop for an evaluation have either been altered or put on hold. While spending has become more discretionary, people still need to make purchases and stay on top of their banking needs. Also, banking, like many things in life, does not just have to happen when branches are open. It can happen at any time, whenever you feel like it. Thankfully, aided by the knowledge that the pandemic has had drastic effects, more and more banks are introducing or expanding existing mobile banking services and the My Synovus Mobile Banking app is no exception. Read on for its benefits.

| My Synovus Mobile Banking | |

| Price: Free Category: Finance |

|

| Version: Varies by device Developer: Synovus Bank |

Uninstall the app: 1. Go to Settings menu 2. Choose Apps or Application manager 3. Touch the app you want to remove 4. Press Uninstall. |

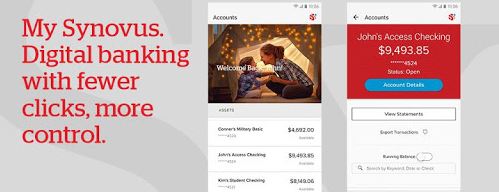

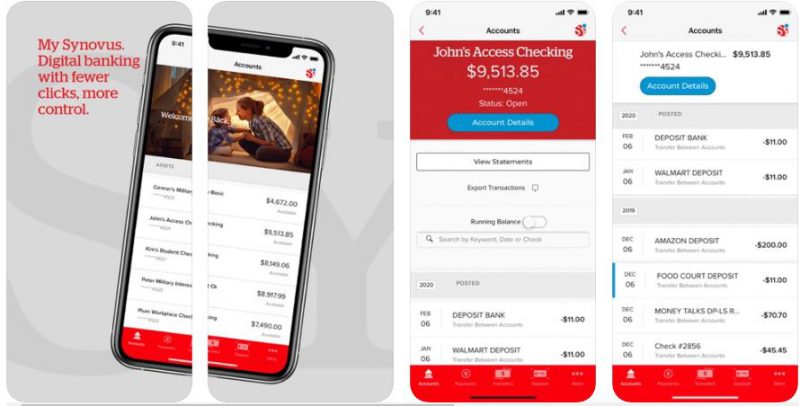

The digital banking app allows users to access the same services and customer care as they would going into a branch, but does not require leaving the house or being in small, crowded spaces. During this time, or anytime, mobile banking has plenty of benefits. Users can access accounts on the go, or from wherever they are sheltering in place.

The Benefits of My Synovus Mobile Banking

My Synovus Mobile Banking brings the bank experience to users. Find out what that means below!

Bank in an Ideal way: Users can bank in a way that is convenient, safe and easily accessible.

Deposit Checks: Check deposit got even easier, since users can just snap a picture of it and it is done. No more having to visit a physical location or a bank!

Send or get Payments: Loan a family member some money? Pay for a friend's brunch order? Do they need payment? Whatever the case, payment can be received or transferred within the app.

Pay Bills: When you need to pay bills on credit or debit cards, banking via mobile makes that process simple. Set up autopay, and never miss a payment again.

Transfer Money: Users who would like to move money from a credit to a savings account, or vice versa, can do that with ease.

View Balances: If staying within a budget is of value, or users just want to see how much they have spent, they can get the facts they need to stay on track.

Find Nearby Synovus Locations: Users can find locations closest to them, so once it is once again safe to do so, they can visit in-person if they so choose.

Free: The app is free to use, so users are inclined to take advantage.

Instant Balances: View balances without signing in. Convenient!

Get Alerted: Whenever important account activity happens, get alerted. Be in the know, always.

Search Transactions: View transactions by keyword, check number and date.

Next-Level Security Measures: With optional multi-step security measures, including fingerprint recognition, security questions, unique usernames and passwords, plus one-time passcodes, used in addition to already established logins, users can have confidence when using the app to manage their finances.

Our Review

My Synovus Mobile Banking is a must for those who use the bank. The mobile app makes finances easier and safer to deal with. All the better that it is free and secure as well. We recommend that those who would like to take charge of their money download and use it regularly. Happy saving! Pretty soon, users will be rolling in the money